Chiron Investment Management team

Chiron Investment Management was acquired by FS Investments in 2020 with the vision to combine FS Investments’ deep expertise in alternative investments with Chiron’s global asset allocation platform.

The FS Chiron Funds are led by Chief Investment Officer, Ryan Caldwell, a pioneer in the global allocation industry and Brian Cho, Head of Quantitative Research. Over the last 20 years the team has tested and refined a proprietary investment process, combining rigorous quantitative analytics with deep active, fundamental research to guide their global asset allocation process. This process aims to serve as a competitive advantage in identifying opportunities and risk across market cycles and provides flexibility to find the best opportunities for growth across regions, style, industry, and sector.

Chiron Investment Management is the adviser for FS Chiron Capital Allocation Fund and FS Chiron Real Development Fund.1

Highlights as of 12/31/2023

$547.0M

Assets under management

2015

Founded

2020

Acquired by FS Investments

20

Average years of experience

Investment management leadership

Ryan Caldwell

CIO, Lead Portfolio Manager

23 years of experience

Brian Cho, CFA

Head of Quantitative Research

28 years of experience

Scott Sullivan

Lead Fundamental Manager

18 years of experience

Watch

Meet the team

Meet the team behind Chiron Investment Management to learn about their history and what drives their proprietary process.

Quantamental approach

Their proprietary quantamental approach is an integrated combination of rigorous quantitative analytics and deep fundamental research to help create an information advantage.

Quantitative investing | Fundamental investing | |

|

| |

What does a company look like today? | What might a company look like tomorrow? |

Quantitative investing | |

| |

What does a company look like today? |

Fundamental investing | |

| |

What might a company look like tomorrow? |

Proprietary investment process

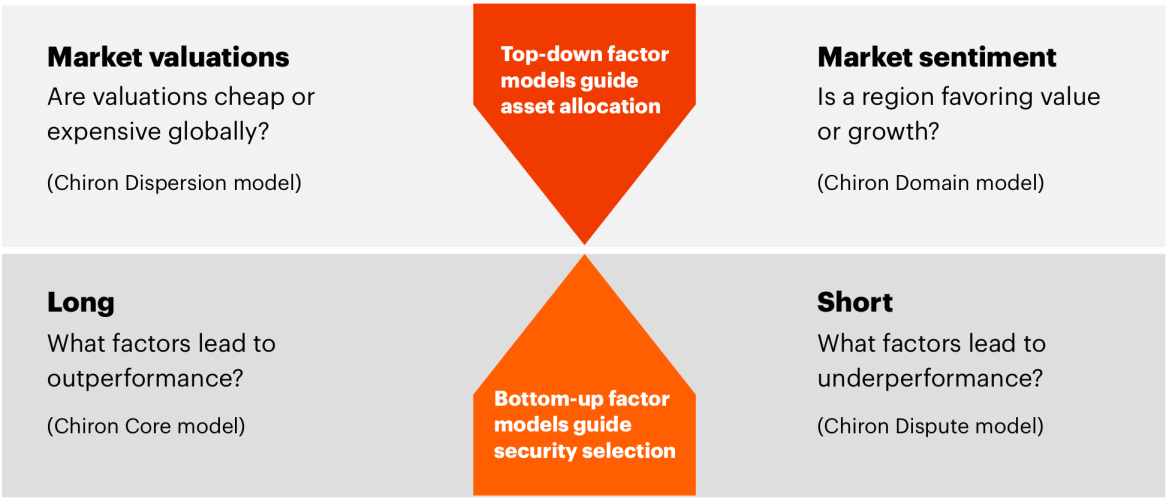

This proprietary investment process, combining fundamental and quantitative research, helps the management team quickly analyze changing market conditions, valuations and investor sentiment and guides their asset allocation decisions.

1

Gather and process data

2

Analyze data through proprietary quantitative research

3

Interpret data and build portfolio through fundamental research

Investment solutions

Learn more about the solutions managed by the Chiron Investment Management team.

FS Chiron Capital Allocation Fund

FS Chiron Real Development Fund

View important disclosures

Effective July 10, 2023, the Fund has been renamed FS Chiron Real Development Fund. Prior to that date, the Fund operated under the name FS Chiron Real Asset Fund.